Property and casualty insurance (also known as P&C insurance) are types of coverage that help protect you and the property you own. Property insurance covers properties you own, like your home or car. Casualty insurance provides liability coverage to help protect you if you are found legally responsible for an accident that causes injuries to another person or damage to others’ belongings. Some examples of P&C insurance are homeowners insurance, car insurance, condo insurance, renters insurance, etc.

Most of the insurance companies including P&C insurance are stuck in time-consuming back-office processes. The large volumes of repetitive business operations and manual tasks limit growth, the ability to deliver quality customer service, and strategic competitive advantage.

The insurance industry is one of the largest industries, generating more than $5 trillion in annual revenue. It plays a key role in today’s economy and yet continues to struggle to achieve the following four universal objectives.

P&C insurance represents $1.6 trillion in premiums (about one-third of the insurance industry) and has yet to be disrupted. In a study performed by McKinsey in 2020 on the state of P&C insurance, “cost reduction and efficiency gains” is listed as one of the top six forces that will shape the industry in the years ahead. While other industries, such as automotive and telecommunications, have reduced unit costs by more than 50% over the past 15 years, administrative cost per policy for the P&C industry in mature markets has remained unchanged or even increased.

Intelligent Automation

Intelligent automation (IA), can be leveraged to improve the end-to-end experience and productivity of the P&C insurance staff by automating repetitive tasks and enabling them to focus on activities that add value to the organization. Intelligent automation is a combination of robotic process automation (RPA) and artificial intelligence (AI) technologies which together empower end-to-end business process automation and accelerate digital transformation. While RPA tends to focus on automating repetitive and rules-based processes, intelligent automation incorporates intelligence through artificial intelligence (AI), machine learning (ML), optical character recognition (OCR), natural language processing (NLP), conversational AI, analytics, and intelligent document processing (IDP). As per Gartner’s IT Automation predictions for 2021, “By 2024, organizations will lower operational costs by 30% by combining hyperautomation technologies with redesigned operational processes”. Hyperautomation is the combination of robotic process automation and intelligent automation that focus on business outcomes by addressing end-to-end business processes.

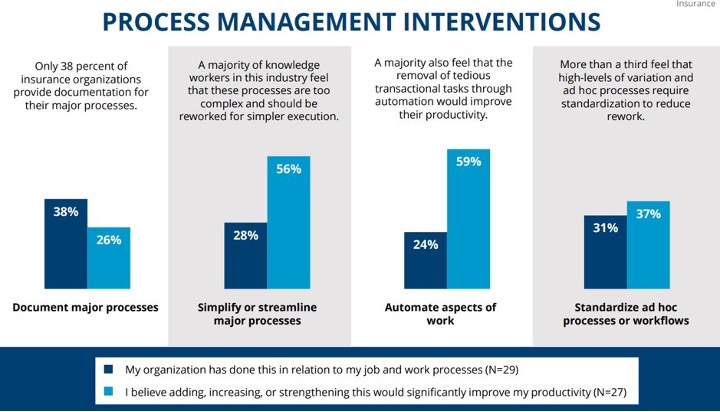

As per the APQC survey report shown below from August 2021 on Fixing Process & Knowledge Productivity problems in the Insurance industry, there is a huge opportunity to simplify the complex processes and remove tedious transactional tasks through automation to improve productivity. Intelligent Automation can help address these opportunity areas.

Source: https://www.apqc.org/system/files/resource-file/2021-

Best Use Cases to Leverage Intelligent Automation in P&C Insurance

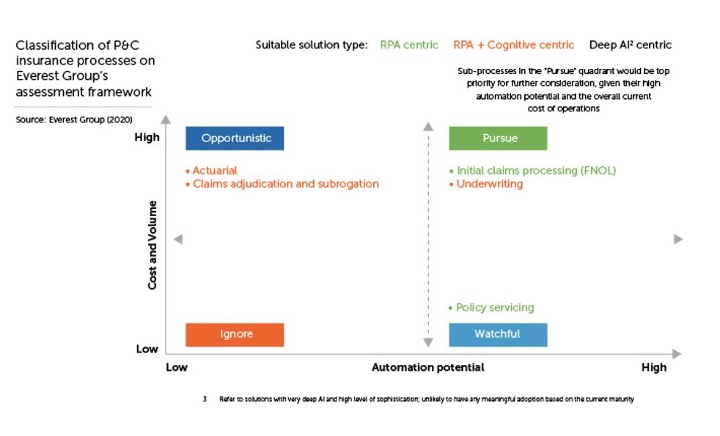

One of the key factors that determine the success of automation in any industry is the selection of the use case. There are several use cases in the P&C insurance industry that can produce tangible results through the implementation of intelligent automation. In the following paragraphs, we will review some of the common use cases.

First Notice of Loss (FNOL)

The First Notice of Loss (FNOL) – the first step in claims processing is one of the most important customer touchpoints for a P&C insurer. For most insurers, FNOL continues to be a lengthy and manual process requiring extensive data gathering. This process translates to high operational costs and cycle time and reduced customer experience. Intelligent automation can automate many of the steps in the P&C FNOL process including claim intake, claim review process, extraction of key data points, and setting up the claim in the P&C company’s claims management tool.

Underwriting

Automating the P&C insurance underwriting process requires a review of multiple documents, with relevant data extracted and manually entered in a downstream processing system. Intelligent automation can help automate the process by “reading” these documents much like a human by leveraging intelligent document understanding. Data extraction and data entry can also be automated, resulting in the number of hours saved for the agent that can ultimately be re-invested in more value-added activities.

Policy Servicing

P&C insurance policy servicing includes numerous steps over its lifetime, including policy processing and printing, endorsements processing, update coverages, audit processing, and addressing customer queries. Intelligent automation can be leveraged to automate most of these processes through robotics process automation (RPA), intelligent document understanding, and conversational AI.

Claims Adjudication

The claims adjudication process is very manual and heavily human-dependent. Each P&C claim generates a high volume of unstructured content in the form of pictures, videos, and audio files that an adjudicator must analyze manually impacting the time it takes to process a claim. Intelligent automation can not only help automate transactional tasks but bring in intelligence and decision making through artificial intelligence/machine learning that can provide insights to the adjudicator on the next best action. This streamlines the adjudication process by reducing operational costs and improving customer experience.

Overall, the potential for intelligent automation in the P&C insurance industry is huge, and it can be a game-changer strategy for insurance companies. Most processes can be fully or at least partially automated, resulting in reduced operational costs, increased employee satisfaction, and improved customer journey. Advanced automation capabilities such as AI/ML, NLP, and conversational ai offer great automation possibilities for insurers that improve their profit margin and transform the customer experience.